The Strait of Hormuz is one of the most consequential maritime routes in the world. It connects the Persian Gulf with the Gulf of Oman and the Arabian Sea, and serves as a vital chokepoint for global energy supplies. Recent developments in the Middle East, including a vote by the Iranian parliament related to the strait, have drawn international attention to this narrow stretch of waterway and highlighted its importance for global trade and energy security.

What Is the Strait of Hormuz?

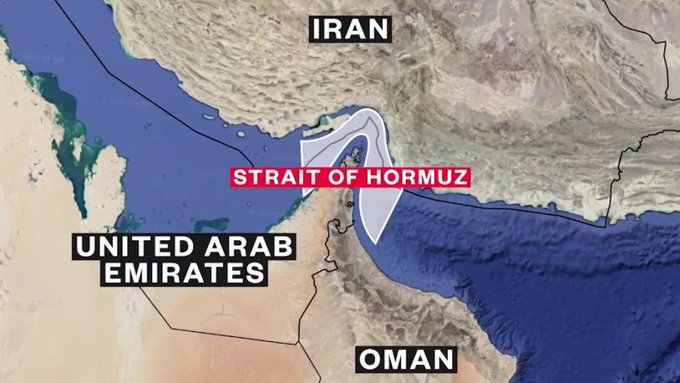

The Strait of Hormuz is a strategic shipping channel located between Iran to the north and Oman to the south. At its narrowest point, the strait is only about 21 miles (34 kilometers) wide, with internationally recognised shipping lanes in each direction.

It functions as a critical conduit for oil and liquefied natural gas (LNG) shipments leaving the world’s major energy producers in the Persian Gulf and heading toward global markets.

Why It Is Critical for Global Energy Markets

According to the U.S. Energy Information Administration (EIA) and energy analysts, the Strait of Hormuz remains one of the most important chokepoints for world energy trade. In 2024 and the first quarter of 2025, approximately 20 million barrels per day (b/d) of crude oil and petroleum products — roughly 20% of global oil consumption — passed through the strait. The strait also accounted for about 20% of global liquefied natural gas trade in the same period.

The vast majority of the oil and gas that traverses Hormuz originates from countries in the Organization of the Petroleum Exporting Countries (OPEC) and nearby Gulf states, including:

-

Saudi Arabia

-

Iraq

-

United Arab Emirates

-

Kuwait

-

Qatar

-

Iran

These exports predominantly flow toward energy-hungry Asian markets. Data shows that China, India, South Korea, and Japan together accounted for a large share of crude oil and gas transported through the strait.

This heavy reliance on the Strait of Hormuz underlines why stable passage through the region is crucial for the global economy.

Recent Iranian Parliamentary Vote and the Strait

In June 2025, the Iranian parliament (Majlis) voted in favour of a motion supporting the closure of the Strait of Hormuz. This vote followed heightened tensions in the region, including U.S. strikes on Iranian nuclear facilities. State-run media reported the parliamentary vote, which was widely covered by international news organisations.

However, several details about that vote are important to understand:

-

The parliamentary vote expressed support for the idea of closing the strait, but it did not itself enact a closure.

-

Under Iran’s constitutional structure, the final authority to decide on such security matters lies with the Supreme National Security Council and the country’s Supreme Leader.

Sources including TIME and Reuters emphasised that while the vote signals political sentiment within the Iranian legislature, it does not automatically translate into action. Decisions of this nature involve multiple branches of government and are subject to broader strategic and economic considerations.

Can the Strait Really Be Closed?

Theoretically, Iran has long suggested that it could disrupt traffic through the Strait of Hormuz. Lawmakers and officials have referenced the option as a potential response to external pressure or military threats. However, actual closure — meaning a complete halt in commercial passage — has never occurred in modern history.

There are several reasons a full closure is widely considered unlikely:

-

Mutual Dependence on the Route

Iran itself is an energy exporter. Halting shipping through Hormuz would harm its own exports, along with those of neighbouring Gulf states, which are major trading partners and critical to Iran’s economy. -

International Security Presence

The U.S. Fifth Fleet and allied naval forces maintain a constant presence in the region, tasked with ensuring freedom of navigation in key shipping lanes. -

Economic Disruption Risk

Blocking the strait would affect not only Gulf states but also major importers of energy, potentially destabilising global markets and creating widespread economic ripple effects.

Experts typically view moves like the parliamentary vote as political signalling rather than an imminent blockade.

Geopolitical Tensions and Energy Prices

Even without an actual closure, the threat or possibility of disruption in the strait can impact energy markets. News reports in mid-2025 noted that oil prices briefly surged amid heightened tensions in the Strait of Hormuz region. Such increases often reflect market concerns about supply risk, even if flows remain uninterrupted.

Financial analysts have suggested that if flows through Hormuz were significantly reduced — for example, to half of normal levels — benchmarks such as Brent crude could experience price spikes. Some predictions estimated prices potentially rising to more than $110 per barrel, before eventually adjusting over time.

Oil markets respond not just to current supply but also to perceived future risk, and the strait’s strategic importance ensures that even political uncertainty has economic consequences.

Global Impact: Who Would Be Most Affected?

Countries differ in how reliant they are on energy imports passing through the Strait of Hormuz:

-

China is one of the largest importers of oil through the strait, with millions of barrels daily entering markets in East Asia.

-

India also depends heavily on Middle Eastern crude, importing more than 2 million barrels per day of oil that transits Hormuz.

-

Japan and South Korea similarly receive a significant share of their energy supplies via the strait.

-

European nations and the United States import some petroleum through Hormuz, but diversification and alternative suppliers have reduced direct dependence.

Because Asian economies import roughly 84% of the oil and gas that transits Hormuz, disruptions could disproportionately affect energy prices and supply planning in the region.

Alternative Routes and Energy Strategy

Some Gulf states have developed or expanded infrastructure intended to reduce reliance on Hormuz. For example:

-

Pipelines from Saudi Arabia and the UAE can transport some crude oil to ports bypassing the strait.

-

Iran has built pipelines to export terminals on the Gulf of Oman, though these currently handle far smaller volumes compared with Hormuz transit.

Despite these alternatives, the capacity of existing bypass routes remains limited and cannot fully replace the volume typically transported via Hormuz.

Historical Context

Tensions around the Strait of Hormuz are not new. The waterway has been at the centre of geopolitical friction for decades due to its strategic value for global energy supply. Historical incidents such as the 1980s Tanker War — part of the larger Iran-Iraq War — demonstrated how conflict in the Persian Gulf could disrupt or threaten maritime traffic without a formal closure.

In more recent years, military and diplomatic efforts by global powers have focused on maintaining security and stability in the strait to prevent such disruptions from materialising.

What This Means for the Global Economy

Economists and energy security experts agree that uninterrupted passage through the Strait of Hormuz is critical for maintaining stable global energy markets. Any credible threat — even if not acted upon — tends to elevate price volatility, which can affect fuel costs, inflation, and broader economic stability.

Professor Guido Cozzi of the University of St. Gallen noted that a blockade would “send shockwaves through the global economy,” underlining how deeply interconnected energy infrastructure, geopolitics, and international trade have become.

Conclusion: Strategic Importance Remains Central

The Strait of Hormuz will continue to be central to global energy trade as long as a significant portion of the world’s oil and gas exports transit through it. While Iran’s parliamentary vote in 2025 brought international attention to the strait, the complexities of international law, economic self-interest, and security policy make a permanent closure unlikely.

What remains clear is that Hormuz’s role as a chokepoint ensures that geopolitical developments in the region are closely watched by energy markets, governments, and international organisations alike.

Understanding the strait’s significance helps explain why even political rhetoric — without actual disruption — can influence global markets and reinforce the need for diversified energy strategies worldwide.